BNB’s Remarkable Ascent: Is an Altcoin Season on the Horizon?

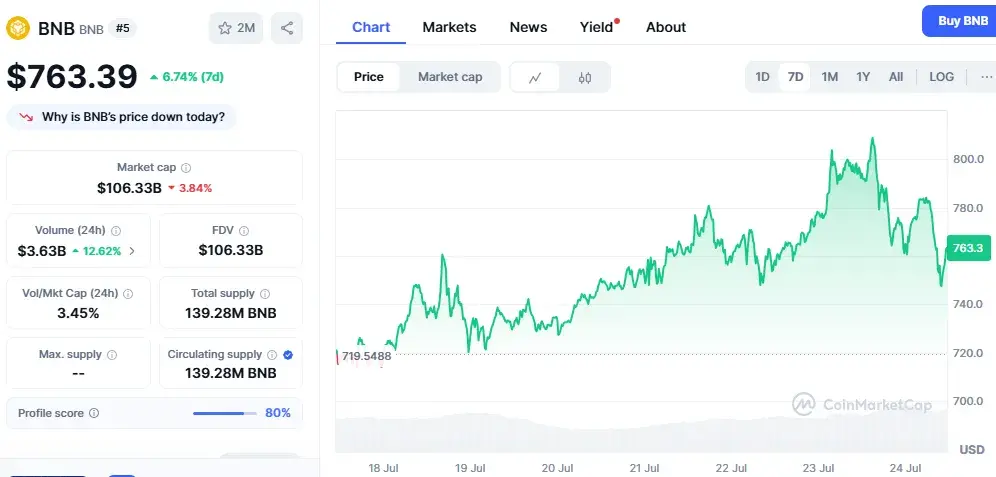

Binance Coin (BNB), the native cryptocurrency of the world’s largest exchange, Binance, has once again captured the attention of the crypto world by achieving an impressive new all-time high (ATH) of $804 on July 22. This significant milestone follows an extended period of sideways trading, spanning over seven months, and is now poised to potentially ignite a broader rally across the altcoin market. Investors and analysts alike are closely monitoring the situation, drawing parallels to the 2021 market dynamics, where a similar breakout by BNB heralded a widespread altcoin surge.

The resurgence of BNB not only reflects growing confidence in its utility and the broader cryptocurrency ecosystem but also underscores a strategic shift in investor behavior. After a prolonged period of consolidation, this decisive move suggests that market sentiment is shifting from cautious optimism to a more bullish outlook. The implications of BNB’s performance extend beyond its own market cap, as its movements often serve as a bellwether for the health and direction of the wider altcoin landscape.

The Accumulation Story: Why Smart Money is Holding BNB

The recent monumental rise in BNB’s value was not a sudden event, but rather the culmination of sustained and strategic investor activity. For nearly two months leading up to this breakout, investors have been systematically accumulating the coin. This consistent buying pressure involved moving BNB away from centralized exchanges and into private, self-custodied wallets. This pattern of off-exchange accumulation, widely recognized in the cryptocurrency space, is a strong indicator of long-term bullish sentiment. When assets are moved off exchanges, it reduces the immediate selling pressure and suggests that holders intend to retain their positions for significant future price appreciation.

Glassnode Data Insights

Data from on-chain analytics firm Glassnode provides crucial insights into this accumulation phase. Glassnode’s reports specifically highlighted this trend, showing a steady increase in the supply of BNB held in non-exchange wallets. This behavior is typically observed when the market anticipates a significant upward price movement. The patience of these long-term holders has now been demonstrably rewarded with the fresh peak of $804. This marks a profound turnaround for BNB, which had largely remained flat and consolidated throughout the latter part of last year. The underlying strength of this accumulation, coupled with a positive shift in the broader market narrative, seems to be the primary catalyst driving this recent change. The unwavering support from these dedicated long-term holders has been instrumental in helping BNB break through multiple critical resistance levels, unequivocally confirming its inherent strength within the current market cycle. This sustained accumulation phase, rooted in fundamental analysis and long-term vision, differentiates this rally from more speculative short-term pumps, laying a solid foundation for continued growth.

Echoes of 2021: Is Another Altcoin Season Brewing?

The crypto market is inherently cyclical, and historical patterns often provide valuable clues about future movements. The last time BNB achieved a new record high, back in 2021, the entire altcoin market experienced an explosive wave of growth shortly thereafter. This historical precedent has not gone unnoticed by market participants. The current surge in BNB’s valuation is widely interpreted as a potential signal for the commencement of another “altcoin season”—a period characterized by significant price appreciation across a broad spectrum of alternative cryptocurrencies. As investor attention increasingly shifts towards the altcoin sector, it is highly probable that smaller, often overlooked coins will soon follow BNB’s lead, experiencing their own rallies. This ripple effect is a hallmark of altcoin seasons, where capital flows from leading assets like Bitcoin and Ethereum into smaller cap cryptocurrencies, driving their values skyward.

Standard Chartered’s Bold Prediction

Adding to the optimistic outlook for BNB, British multinational bank Standard Chartered previously made a noteworthy forecast. As highlighted in our earlier reports, the bank predicted that Binance Coin’s value could more than double by 2025. This ambitious forecast is underpinned by expectations of increasing institutional confidence and the potential for new Exchange Traded Fund (ETF) filings specifically for cryptocurrencies. The entry of institutional capital, often seen as a sign of market maturity and legitimacy, would undoubtedly provide a significant boost to BNB’s valuation and the broader crypto market. Should these institutional flows materialize, they could act as a powerful catalyst, driving the price far beyond current levels and cementing BNB’s position as a leading digital asset. The convergence of retail accumulation, historical patterns, and institutional interest paints a compelling picture for BNB’s future trajectory.

Navigating the Current Market: Targets and Cautionary Notes

Following its impressive jump to $804, BNB’s price has seen a slight pullback, settling in the range of $799. However, analysts remain overwhelmingly bullish on its near-term prospects. The next critical level that market observers are closely watching is the $850 mark. If the current bullish momentum continues unabated, this target could be reached within the coming days. A successful breach of the $850 resistance would not only signify continued strength but also attract fresh interest from a new wave of investors, potentially providing even more robust support for the ongoing rally. The psychological impact of hitting new milestones often draws in sideline capital, creating a positive feedback loop that can propel prices even higher.

Key Resistance and Support Levels

Despite the prevailing optimism, a degree of caution is being shared among some market participants. While the outlook is strong, the crypto market remains inherently volatile. If investors decide to take profits too aggressively or prematurely, there is a risk that BNB could slip below the crucial support level of $741. This price point has become a key battleground between bulls and bears; a sustained fall below it could significantly alter the short-term outlook and potentially lead to a broader market pullback. Such a scenario would imply a re-evaluation of current market sentiment and could trigger a wave of selling, leading to a consolidation or even a deeper correction. Therefore, while the path of least resistance appears to be upwards, vigilance regarding key support levels is paramount for investors.

Market Capitalization and Current Trading

BNB remains a titan in the cryptocurrency space, consistently ranking among the leading cryptocurrencies by market capitalization. As of the latest reports, its market cap stands impressively at $109.89 billion, solidifying its position as a dominant force. MarketCap data further indicates that it is currently trading at approximately $795, representing a healthy 3.89% increase in the last 24 hours. This strong performance, even after hitting an ATH, demonstrates underlying buying interest and resilience. The large market capitalization not only reflects its widespread adoption and utility within the Binance ecosystem but also contributes to its stability compared to smaller, more volatile altcoins. The consistent trading volume and positive percentage change in recent hours suggest that the momentum is still largely in favor of the bulls, with sustained interest from both retail and potentially institutional investors.

Stay informed, read the latest crypto news in real time!

Conclusion: A Promising Horizon for Binance Coin

The recent surge of BNB to a new all-time high of $804 is a testament to its robust ecosystem, strong investor confidence, and growing utility. The strategic accumulation by long-term holders, coupled with historical market patterns hinting at an impending altcoin season, paints a highly optimistic picture for Binance Coin’s future. While the $850 target looms large, and caution regarding the $741 support level is warranted, the overall trajectory for BNB appears firmly upward. Its significant market capitalization and consistent performance underscore its pivotal role in the cryptocurrency landscape. As the digital asset market continues to evolve, BNB stands poised to lead the charge, potentially ushering in a new era of growth for altcoins and reaffirming its status as a cornerstone of decentralized finance. Investors and enthusiasts will undoubtedly keep a close watch on this influential cryptocurrency as it navigates the exciting challenges and opportunities ahead.