Mexican Real Estate Giant Grupo Murano Goes All-In on Bitcoin with $200 Million Investment

In a bold strategic pivot, Mexican real estate conglomerate Grupo Murano has announced plans to allocate a significant portion of its assets to Bitcoin, signaling a major vote of confidence in the leading cryptocurrency. The company intends to invest a total of $200 million in Bitcoin, with the ambitious goal of Bitcoin comprising 80% of its investment portfolio in the near future. This move is part of a larger business model restructuring aimed at deeply integrating Bitcoin into its operations.

Elias Sakal, the CEO of Grupo Murano, revealed in an interview on “The Bitcoin for Corporations Show” that this strategic shift will involve the company holding up to 80% of its portfolio in Bitcoin. To facilitate this transition, Grupo Murano will employ strategies such as refinancing and sale-and-leaseback arrangements on select properties. The remaining 20-30% of its investments will be maintained in highly liquid real estate assets, providing a balance alongside their substantial Bitcoin holdings.

Strategic Advantages of Bitcoin for Real Estate

Sakal emphasized that the adoption of Bitcoin extends beyond mere investment. He anticipates that integrating cryptocurrency payments and installing Bitcoin ATMs in their hotels will offer operational cost savings. Furthermore, he believes that holding Bitcoin will provide a crucial hedge against the volatility of interest rates, a significant concern for industries with substantial debt burdens, such as the real estate sector. By diversifying into a decentralized asset like Bitcoin, Grupo Murano aims to mitigate some of the financial risks associated with traditional fiat currencies and interest rate fluctuations.

Bullish Outlook: $10 Billion Bitcoin Holdings Within Five Years

The leadership at Grupo Murano holds a highly optimistic long-term view on Bitcoin’s potential. Sakal projects that Bitcoin’s value will increase 300-fold within the next five years. Based on this projection, the company aims to grow its Bitcoin holdings to an impressive $10 billion over the same timeframe. This ambitious target underscores their conviction in Bitcoin’s transformative power and its potential to generate significant returns. Grupo Murano has already initiated its Bitcoin strategy, having acquired 21 BTC in July 2025. Additionally, they entered into a $500 million share deal with Yorkville, further bolstering their financial capacity for this strategic shift.

Integrating Bitcoin into Hotel Operations

Grupo Murano’s commitment to Bitcoin extends beyond treasury management. The company plans to fully integrate the use of Bitcoin within its hotel ecosystem. Guests will soon have the convenience of paying for their stays and services using Bitcoin. To further facilitate cryptocurrency adoption, Grupo Murano intends to install crypto ATMs in the lobbies of its hotels, making it easier for both seasoned crypto users and newcomers to interact with Bitcoin. Recognizing the importance of education in fostering widespread adoption, the company also plans to enhance digital asset literacy through the acquisition of events and the development of publishing training materials. This comprehensive approach aims to create a seamless and educational experience for hotel guests interested in using Bitcoin.

Embracing the MicroStrategy Model

According to Sakal, this strategic embrace of Bitcoin aligns with the approach championed by MicroStrategy’s Michael Saylor, who advocates for Bitcoin as a primary corporate treasury asset. Grupo Murano’s objective is to hedge against the inherent risks associated with fiat currencies by strategically converting a substantial portion of its balance sheet into Bitcoin. They believe this move will unlock significant long-term capital gains, positioning the company for sustained financial growth in the evolving economic landscape.

Volcon Accelerates Bitcoin Strategy Amid Rebrand to Empery Digital

Grupo Murano is not alone in recognizing the potential of Bitcoin as a corporate asset. Nasdaq-listed Volcon, an electric powersports company, has also made a significant commitment to Bitcoin. Volcon allocated over $475 million – a remarkable 95% of its recent $500 million funding round – to Bitcoin. The company currently holds more than 280 BTC, with a notable 235 BTC being directly accepted from investors in lieu of fiat currency. This demonstrates a growing acceptance of Bitcoin as a legitimate form of capital among institutional investors. Notable investors in Volcon’s Bitcoin-focused raise included Pantera Capital, FalconX, Borderless, and Relayer Capital, indicating strong institutional support for this strategic pivot. The executive team within Volcon also fully endorsed this move, highlighting a unified vision for the company’s future. To ensure the secure management of its Bitcoin treasury, Volcon has partnered with Gemini, a leading cryptocurrency exchange and custodian.

Rebranding to Reflect Digital Asset Focus

In a move that further underscores its commitment to the digital asset space, Volcon is undergoing a rebranding. The company will now be known as Empery Digital, Inc., with its electric mobility division operating under the name Empery Mobility. The new ticker symbol, EMPD, will signify this new strategic direction, clearly communicating the company’s focus on and involvement in the realm of digital assets. This rebranding effort aims to align the company’s identity with its core business strategy moving forward.

Favorable Regulatory Landscape Encouraging Bitcoin Adoption

The announcements from Grupo Murano and Volcon come at a time when the regulatory environment for digital assets in the U.S. is becoming increasingly formalized. In July 2025, then-President Trump enacted stablecoin regulation, providing clearer guidelines for the adoption of these digital currencies by corporations. Furthermore, broader cryptocurrency legislation is reportedly in progress, indicating a growing acceptance and understanding of digital assets within the regulatory framework. These developments are likely playing a significant role in encouraging companies like Grupo Murano and Volcon to embrace Bitcoin as part of their corporate strategies.

Stay informed, read the latest crypto news in real time!

Bitcoin Market Overview

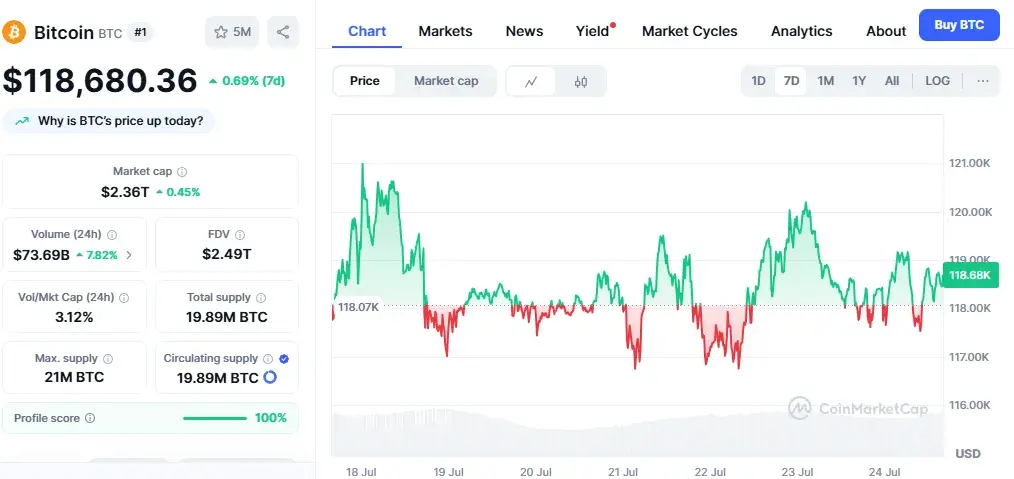

As of the latest data, Bitcoin is trading at around $118,337, showing a modest 0.5% increase in the last 24 hours, although it has experienced a slight 0.2% drop over the past 7 days. During the trading session, Bitcoin reached a peak of $120,269 before retracing. The trading volume has seen a significant increase, rising above $71.17 billion, which represents a 2% increase within the last 24 hours. These market movements reflect the ongoing interest and activity surrounding Bitcoin as more institutional players enter the space.

Conclusion: Grupo Murano Leads Corporate Bitcoin Adoption Wave

Grupo Murano’s bold decision to allocate a substantial portion of its portfolio to Bitcoin and integrate cryptocurrency payments into its operations marks a significant milestone in corporate Bitcoin adoption. Their bullish outlook, coupled with the strategic moves of companies like Volcon, underscores the growing recognition of Bitcoin as a valuable treasury asset and a potential driver of future growth. As the regulatory landscape becomes clearer and institutional interest continues to rise, we may see more traditional companies following the lead of Grupo Murano, further solidifying Bitcoin’s position in the global financial ecosystem.